Money-saving shouldn’t be a “want” nowadays, but more of a “must-do”.

We can all do with money-saving and whether you hope to accomplish that by depriving yourself of that £3 morning latte or putting off your next vacation, we all have our own ways of saving money.

Here’s what we recommend you do to save money:

Basic Money-Saving Tips

Cut down on debt

Set some savings goals

Pay your bills on time

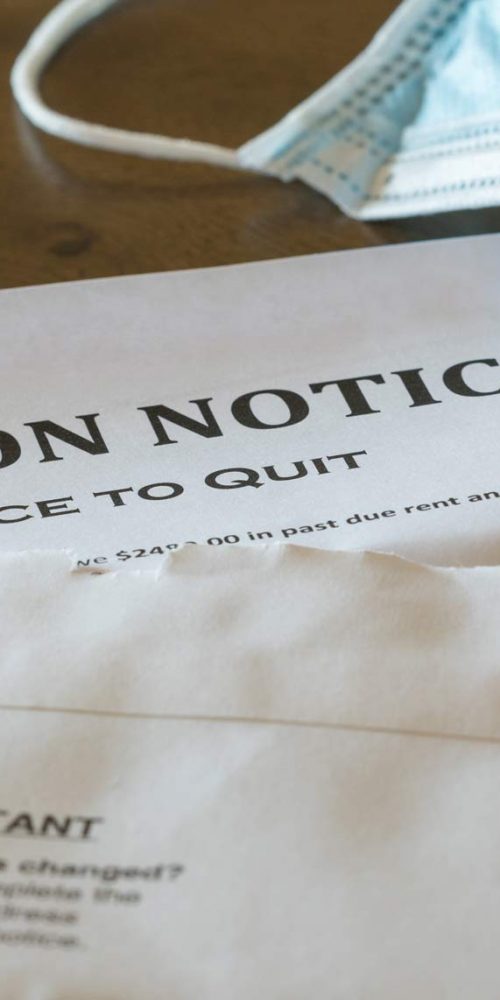

How To Save Money During Lock Down

How to save money during lock down at the beginning of the government-issued lock down period, you might have been fooled into thinking that you would save a significant amount of cash.

the money that you would have spent on commuting and meals out is now going towards additional groceries for the family during the working week and increased electricity bills. So, in order to help you make some savings during your time self-isolating, we’ve put together a few handy savings tips.

1) Create A New Budget

While you’re in lockdown, don’t assume that your spending will stay the same. Your spending might fall in some areas and rise in others and your income might drop, so make sure that you set time aside to sit down and create a new budget for the period you’ll be self-isolated for. Now that you’ll be spending more on water, electricity, heating and groceries, you need to set more realistic limits for your expenses and set new targets for how much you’d like to save every week or month.

2) Plan Your Food Shop

It might be tempting to grab as much food as you can from the supermarket now that the shelves are bare and the queues are long, but it’s important to keep a clear head and not shop impulsively. Before you head out to buy groceries, write out a meal plan for the week with ingredients that you would prefer to cook with and some substitutes in case they are not in stock. Set a budget for yourself so you don’t end up picking up items without thinking about it and ensure that you only buy the essentials.

3) Don’t Be Afraid To Ask For Help

If the coronavirus pandemic has left you out of work or you’ve experienced a pay cut and you’re struggling to make ends meet, don’t be afraid to ask for financial aid from the government. You might be able to get rid of any overcharges from your bank, ask for a rent reduction or a mortgage holiday or apply for job seekers’ allowance or universal credit. Get in touch with your employer, HMRC, your bank or any companies that you pay regularly and let them know about your financial situation. You can also access debt consolidation loans for bad credit to cover your multiple repayments.

Money-Saving for Students & Young Adults

For students: Use credit cards wisely

Be very smart about food shopping

For young adults: Start budgeting

Little savings amount to big savings

You can Save Money easier than you Realise

Consider buying in bulk or cooking from scratch, rather than heading to a takeaway or popping expensive ready-made deals into your shopping basket. Inexpensive pasta, potatoes and rice are always worth considering as meal staples. They don’t take too long to cook and are quite filling.

Have a look at the NUS extra card. It is worth considering buying it if you use the high street shops and restaurants they offer money-off or deals for. It may not suit everyone, but it certainly has quite a few places with offers.

Even if you don’t have an NUS extra card, always ask in shops and restaurants if they offer student discounts because many do. Always take a few minutes to research discounted websites, which also may offer free membership and student discounts.

Consider the cost of printing

Research how much an actually buying your own printer may cost, instead of using printing services. Not only could it save you money, but also the hassle of queues and rushing around shops trying to print pages and pages of essays or dissertations.

Employee discounts

If you’re looking to work around your studies and are passionate about fashion or make-up but feel you can’t afford it while studying, then it’s worth doing a bit of research as to where to apply for work. There are many high street shops which offer really good discounts for employees, which could be up to 50%. That’s definitely worth a look.

Don’t dismiss websites which offer recycling items like TVs, tablets, bikes, etc.

It’s always worth a quick look around local charity shops while shopping.

Car boot sales can also be worth a trip

But all the good stuff is often gone first thing… so an early start is advised!

Saving Tips for Low-Income Earners

Be mindful about your spending

Establish a savings action plan

Keep your debts down

Saving Tips for Millennials

Live within your means

Save today

Focus less on material spending

Money-Saving Tips for Families

Make your own food

Be realistic and positive

Unplug electrical appliances when not in use

Money-Saving Tips for Singles

Move your mortgage

Budget, budget, budget!

Put money aside for old age

Money-Saving Tips for Small Business Owners

Hire a virtual assistant

Host your own website

Let your employees work from home

Money-Saving Tips for Grocery Shopping

Overspending at the supermarket on the weekly shop is very easy to do.

Often you think you’ll spend around £60 and, before you know it, the shopping trolley is overflowing and it ends up costing over £100 in total!

How do you get better at sticking to a strict grocery budget, so it’s not a knock-on effect on the other financial commitments you have every month?

Here are some helpful tips for your next grocery outing – to cut back on weekly supermarket spending

Write a list

Plan your evening meals for the upcoming week. What exactly do you need, work it all out. Write a shopping list and don’t get attracted by any bargains along the way. You can easily be distracted.

Buy own brands within the supermarket

You probably didn’t know that many of the main brands supply the supermarkets with their own-brand products. If you know somebody quite knowledgeable about this, it’s worth asking them about it or do some research, this will save you quite a lot if you switch.

Stock-up when there’s a sale

If non-perishable products are on sale, then stock-up and you’ll save quite a bit across the year. You don’t need to hoard, so if you have the room at your home then buy what you are able to for a long-term financial savings benefit. If you can see if you can find a wholesale warehouse store that offers bulk items at discounted rates, these are well worth a trip to.

Read the label

Larger items can look like a great deal, but you might find that two of something is better value. Allow a bit of time to work through this, but once you know what is a bargain and what is not, then you know next time you shop what’s more cost-effective.

Coupons

Always save coupons and give them in at the till at the end to save some money. You can reach a decent amount off if you can shop savvy around coupons you have.

Shop on a full tummy, not when you are hungry!

If your tummy is rumbling, then you will not be focused on your list. Before you know it, you’ve either put extra items in your basket or eaten half the content before you get home!!!

Always compare prices

Make fewer trips to the grocery store

Go shopping on a full stomach. Sounds strange, right?

Tips on How to Save for a Holiday

Create a holiday bank account

This might sound a little over the top, but by opening separate savings account for your holidays, you’ll have a dedicated pot into which you can save some of your disposable income.

This won’t result in you instantly having more cash, obviously, but it will provide you with a focus for your savings and ensure those vital funds aren’t swallowed up by day-to-day activities.

Most bank accounts will let you open additional savings accounts for no cost (you may have to pop some funds in immediately, mind), and if you hide away the accompanying card, you’ll have no inclination to withdraw the money until your holiday arrives.

Buy at specific times of the day

Trim your closet

Spend less each month

Sometimes, the simplest money saving techniques are the best, and this is about as simple as it comes. How to save? Spend less.

If you don’t already, create a monthly budget. Add up your regular outgoings – everything from the coffee you buy each morning to the clothes shop that’s a regular feature halfway through the month.

Once all of your expenditure is listed, take a look at where you can make cuts. Regular meals out, coffees, big food shops that inevitably result in waste; there will be more areas than you might think in which you can make savings.

It won’t always be easy, but the more you cut back each month now, the more you can enjoy your summer holiday when it arrives.

Fire-up a side-business

We live in an age now where more and more people are striking up side ventures alongside their regular jobs in order to broaden their career opportunities and make a bit of extra cash.

For you, that could simply be emptying your old wardrobe to make some sales on eBay. Or, you might have a hobby that could be turned into a money-making venture such as design, writing or photography.

There’s a wealth of options for people who want to earn a little extra in the digital age. Take a look at PeoplePerHour and TaskRabbit.

Make credit cards work for you

There’s nothing wrong with credit cards, providing you spend within your means and pay off the balance each month to avoid interest charges.

What’s more, some of the best credit cards will help you earn money!

Look for cards that offer handsome cashback, and those which will earn you air miles. With so many credit card providers on the market, they’re all battling for your attention, which means there’s plenty of good deals to be had. MoneySavingExpert remains a great source of information on the best credit card deals.

Saving for a Mortgage Tips

Sub-let space but only if your rental agreement allows it

Make your own lunch

Limit the nights out

Can you Save Money with a Loan?

Yes, you can, if you qualify for a lower interest rate. Just make sure you are able to repay the loan within the loan repayment timeframe. Even better, get a debt consolidation loan and you can improve your credit score in the process.

Can you put Student Loan Money in a Savings Account?

Yes, you can. By keeping your cash in a high-yield savings account, you can earn extra interest on your funds. However, you must beat the interest rate that’s charged on your loan in order to gain any worthwhile benefits.

Do you Save Money by Paying off a Loan Early?

Yes – since you pay interest on personal loans every month, paying them off early means you save money in ways other than on your interest.

Does Debt Consolidation Save Money?

Consolidating all your debts from different credit cards and loans into a single amount may get you a lower interest rate, which saves you money over time. In addition, it can strengthen your finances and even get you a better credit score in future.

From debt consolidation for paying off several credit cards through to a consolidation loan that ensures you only need a budget for a single debit payment. There are all sorts of reasons why individuals turn to consolidated borrowing as a solution to their financial woes. One of the major advantages of a suitable debt consolidation loan is that it can actually save you money! Take a look at three ways that a debt consolidation loan could mean that you end up paying less in the medium-term.

Get Rid Of Your High-Interest Borrowing

Credit cards, in particular, are well-known for the high rate of interest (APR) which they attract. Particularly if individuals aren’t paying their credit card back in full each month, it’s all too easy for the interest to become unmanageable. Whilst it’s important to check the duration and APR of the loan aren’t such that you’re going to end up worse off, in many cases a loan is cheaper to service than continuing to make minimum payments to several credit cards.

Avoid Late Fees And Non-Payment Penalties

If you’re struggling with making monthly payments on your debt, you’re probably already familiar with the problems which late fees and penalty payments can bring. These simply make the situation worse, as individuals are in an even worse financial position and still owe their payment! With a consolidation loan, provided you stick to the repayment schedule, there will be no penalty payments or late charges.

Begin To Rebuild Your Credit Record

Default on a credit card or bill and the information will soon be transferred to your credit record. This warns other lenders that you’re not keeping up with your current financial obligations. In turn, this means that it may be difficult to get credit in the future because you are perceived as a risk. This could force you to use sub-prime lenders, whose interest rates are significantly higher than the market average. A consolidation loan enables you to pay off your creditors. Provided you keep up the repayments, it’s possible to rebuild your credit history, enabling you to take advantage of more favourable borrowing in the future.

We offer Debt Consolidation Loans for homeowners.

Our team is on hand to help with number of questions you may have.

If you are struggling with debt, please visit Money Advice Service for help and advice.

We are a broker, not a lender.