Understanding the Urgent Need for Support with Tax Deadlines

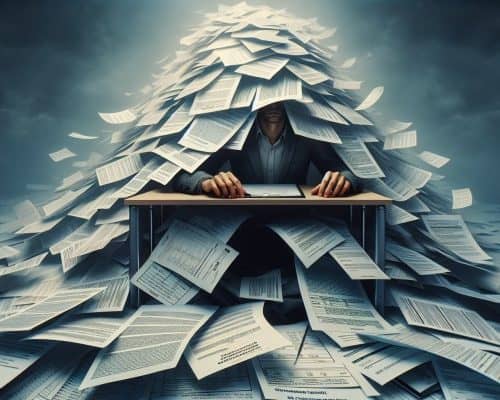

Recent findings show that a significant 25% of self-employed individuals in the UK are contemplating delays in their tax payments for the 2019-20 fiscal year. This decision stems from the financial challenges posed by the coronavirus pandemic and the resulting restrictions. A survey conducted by Which? involving 4,000 taxpayers reveals the pressing need for support regarding tax deadlines. Such insights underscore the necessity for effective solutions tailored to assist those struggling to meet their financial obligations during these unprecedented times.

The crucial deadline for submitting tax returns is the 31st of January, a date that also marks the payment due for the 2019-2020 tax year. Alarmingly, one in four self-employed taxpayers has already opted to postpone their payments, which are due in less than two weeks. This scenario is compounded by the fact that approximately 22% of these individuals had previously taken advantage of the government’s offer to defer their payments due by July 2020. The survey further estimates that UK taxpayers will collectively spend around 19 million hours preparing their tax returns by the impending deadline.

Despite the approaching deadline, not all taxpayers have finalized their plans. About 16% remain uncertain about their course of action or have yet to give the matter serious thought. Moreover, over 42% have indicated that they have already chosen to defer their July payment due to ongoing financial distress. This highlights the widespread impact of economic strain on tax compliance, emphasizing the need for accessible support services.

The UK government has implemented a Time To Pay scheme, which allows taxpayers to spread their tax bill payments throughout the year via monthly installments. This option provides a less overwhelming approach to managing tax liabilities; however, it is essential to note that interest will accrue on any remaining balance. Taxpayers should carefully consider this alternative if they find themselves struggling to meet their tax obligations.

The Time To Pay scheme is always available, regardless of the pandemic’s impact, and should not be confused with the government’s option for deferring payments initially due by July 2020. The latter was part of a broader range of financial relief measures introduced to support self-employed individuals, allowing them to defer their payment deadlines until 31 January 2021.

The Importance of Timely Tax Payments to Avoid Penalties

Failing to submit your tax payment by the 31st of January 2021 can lead to serious financial repercussions. Taxpayers must proactively contact HMRC to establish a viable alternative, such as a Time To Pay agreement, if they wish to avoid incurring penalties. Being late with tax payments can result in a substantial interest charge of 2.6% applied from the original payment due date. Furthermore, a 5% penalty on the outstanding tax will be imposed after 30 days, along with an additional 5% fee on 31 July 2021, and another 5% levy after one year of late payment. These financial implications stress the importance of meeting tax obligations promptly.

Steps to Take If You Cannot Pay Your Tax Bill on Time

For individuals facing financial difficulties who are unable to meet their tax obligations, the government has established various support schemes. One potential option is to negotiate an agreement with HMRC through their Time To Pay scheme; however, eligibility comes with specific criteria:

- You must owe less than £30,000 in tax

- The arrangement should be initiated within 60 days of the payment deadline

- Your tax returns must be current and completed

- You should have no outstanding debts with HMRC

- You do not currently have any other payment plans or agreements with HMRC

If your tax debt exceeds £30,000 or you anticipate needing more than the maximum 12 months allowed by the Time to Pay scheme, it is still possible to discuss alternative installment arrangements. The most crucial step, if you are uncertain about your ability to pay your tax bill or need guidance on delaying your payment, is to contact the HMRC Payment Support Service at 0300 200 3835. Taking proactive measures can help you navigate these challenging financial times effectively.

Discover Related Resources That Can Help You

How to Cope with Debt Consolidation Setbacks: A Guide

How to Cope with Debt Consolidation Setbacks: A Guide

How to Cope with Debt Consolidation Setbacks: A Guide

Debt Consolidation Loan: An Engaging Video Guide

Debt Consolidation Loan: An Engaging Video Guide

Debt Consolidation Loan: An Engaging Video Guide

Overcoming Debt Shame With Consolidation Loans: UK Guide

Overcoming Debt Shame With Consolidation Loans: UK Guide

Overcoming Debt Shame With Consolidation Loans: UK Guide

Is Debt Consolidation a Scam or Legit: A UK Guide

Is Debt Consolidation a Scam or Legit: A UK Guide