Understanding When Debt Levels Become Unmanageable

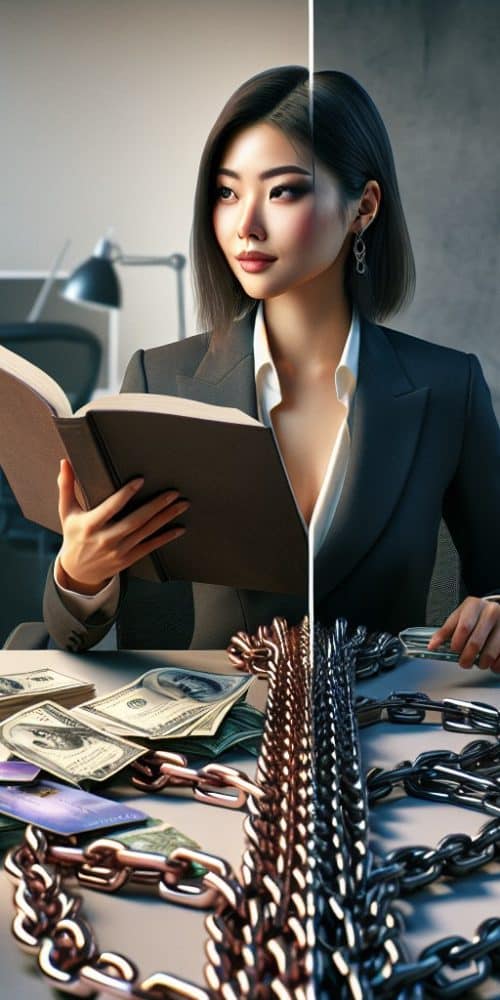

Debt consolidation loans can be instrumental in addressing various debt challenges you may face, but it is crucial to acknowledge that they should only be considered when your financial obligations spiral out of control and become unmanageable.

When handled correctly, debt can serve a positive purpose – particularly if it’s facilitating your journey towards enhancing your overall personal wealth. However, unchecked debt can lead to severe financial distress, potentially triggering a downward spiral that may seem irreparable in dire scenarios.

Determining Your Debt Threshold: When Does Debt Become Too Much?

It’s vital to understand that the total amount of debt is not the only metric of concern; rather, the focus should be on your monthly repayment commitments. If your monthly payments are within your financial reach and manageable, that’s a positive sign. Conversely, if these repayments are burdensome, you may find yourself in financial turmoil.

This is precisely where debt consolidation loans can play a pivotal role; by lowering your total monthly payment obligations, they can transform what seems like overwhelming debt into a manageable situation, allowing you to regain financial stability.

The critical measurement to assess your ability to handle debt is the ratio of your monthly debt repayments to your gross monthly income – the income you earn before taxes and other deductions. This ratio is commonly referred to as the debt-to-income ratio, and it serves as a crucial indicator of financial health.

While there isn’t a strict benchmark for acceptable debt-to-income ratios, a figure exceeding one-third – or 33 percent – of your gross monthly income allocated to recurring debt payments can indicate potential financial troubles. This is particularly pertinent if you do not have a mortgage, as lenders may hesitate to approve mortgage applications when your debt-to-income ratio exceeds the low 40s percentage-wise.

It’s important to remember that a mortgage is a form of debt as well; thus, incorporating that into your calculations can push your debt-to-income ratio even higher. In some circumstances, financial advisors might suggest that a debt-to-income ratio approaching 50 percent could still be considered manageable, depending on individual circumstances.

Generally speaking, a debt-to-income ratio falling between approximately 35 percent and 49 percent is often a warning sign of potential financial difficulties ahead.

However, it’s important to note that these guidelines are not absolute. The nature of the debt you carry significantly influences what is considered manageable. For instance, loans that are secured against an asset, such as mortgages, are typically viewed more favorably, whereas high levels of credit card debt can pose serious risks to your financial well-being.

Explore Additional Resources for Debt Management:

Managing Anxiety During Debt Consolidation Effectively

Managing Anxiety During Debt Consolidation Effectively

Managing Anxiety During Debt Consolidation Effectively

Debt Consolidation Loan APR Breakdowns: UK Guide

Debt Consolidation Loan APR Breakdowns: UK Guide

Debt Consolidation Loan APR Breakdowns: UK Guide

Can Debt Consolidation Stop Bailiff Action?: Key Insights

Can Debt Consolidation Stop Bailiff Action?: Key Insights

Can Debt Consolidation Stop Bailiff Action?: Key Insights

APR: Understanding the Annual Percentage Rate of Charge

APR: Understanding the Annual Percentage Rate of Charge

APR: Understanding the Annual Percentage Rate of Charge

Debt Consolidation Loan Interest Rate Trackers

Debt Consolidation Loan Interest Rate Trackers