How can debt affect your mental health?

Having debt can cause a massive amount of stress. You wake up each morning with a feeling of dread hanging over you as you try to work out where you will get money from to pay your next bill. If this sounds like you, it may be time to take care of your debt once and for all. Life is just not as enjoyable with a dark cloud of debt hanging over you, and it can start to take its toll on your mental health. Below we’ve examined some of the effects debt can have on your mental health and some suggestions about what to do.

Poor sleep and overall health

When you have debt weighing on your mind it can be difficult to sleep at night. Studies show that lack of sleep can lead to poor concentration, irritability and other long-term effects. Dealing with your debt will lead to less stress and a better night’s sleep and improved overall health, leaving you better able to cope with other life events.

Depression

It is hard to enjoy life when you are concerned about debt. This can lead to depression and anxiety, which can cause you to bury your head in the sand and not deal with your debt problems. If your depression is caused by debt, then instead of only trying to treat the depression with medication or therapy, taking some positive steps to start clearing your debts could help improve other symptoms of mental illness.

Social isolation

If you are in debt, you may find you miss out on a lot of events such as celebrations, days out and holidays as you will not be able to pay for them. It can feel very isolating listening to your friends talk about their trip abroad when you are struggling to afford a weekend away and risks making your anxiety worse. Taking small steps to tackle your debt will help you feel more in control and mean you can get back to enjoying social events again.

One of the easiest and most effective ways to clear existing debt is with a debt consolidation loan for bad credit. There are many reasons to take out a debt consolidation loan, but the most important one is that instead of several debts you will have one helpful payment loan, greatly reducing your stress levels. Get in touch with Debt Consolidation loans today. We offer debt consolidation for married couples, self-employed debt consolidation loans, business debt and school fee consolidation loans amongst others. Get in touch today and look forward to a stress-free future.

If you’re a homeowner and business owner, get in touch with the experts at Debt Consolidation Loans today for more information about how a debt consolidation loan can benefit you.

If you think a Debt Consolidation Loan is right for you, get in touch or call on 0333 577 5626 to improve your financial situation with one easy monthly repayment.

We offer Debt Consolidation Loans for homeowners.

Our team is on hand to help with number of questions you may have.

If you are struggling with debt, please visit Money Advice Service for help and advice.

We are a broker, not a lender.

Visitors also read:

Modern Times, The Death of Cash

Modern Times, The Death of Cash

Modern Times, The Death of Cash

How can debt affect your mental health

How can debt affect your mental health

How can debt affect your mental health

Competition Is Key to Loan Deals

Competition Is Key to Loan Deals

Competition Is Key to Loan Deals

What is a Pension Loan?

What is a Pension Loan?

What is a Pension Loan?

A quick guide to spotting debt consolidation scams

A quick guide to spotting debt consolidation scams

A quick guide to spotting debt consolidation scams

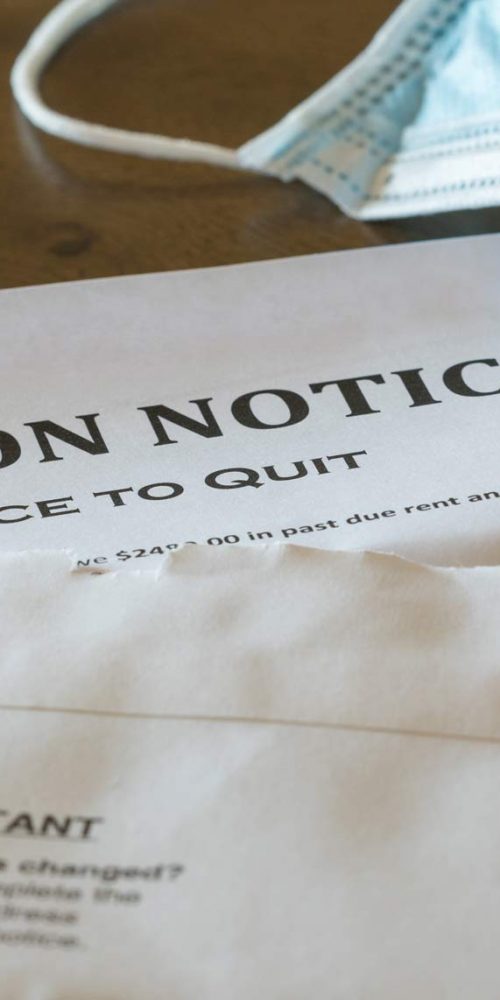

Evictions Postponed Until End of March but Cars Can Be Seized

Evictions Postponed Until End of March but Cars Can Be Seized